Having unorganized home files does more than just collect dust and clutter, but it can become a mental drain. These further manifests toward a decreasing desire to take control back from your paper clutter and organize your files. This detailed guide outlines what documents are important to keep and for how long versus those you can toss. By following this list and additional tips, you will be able to successfully plan the completion of organizing your home files.

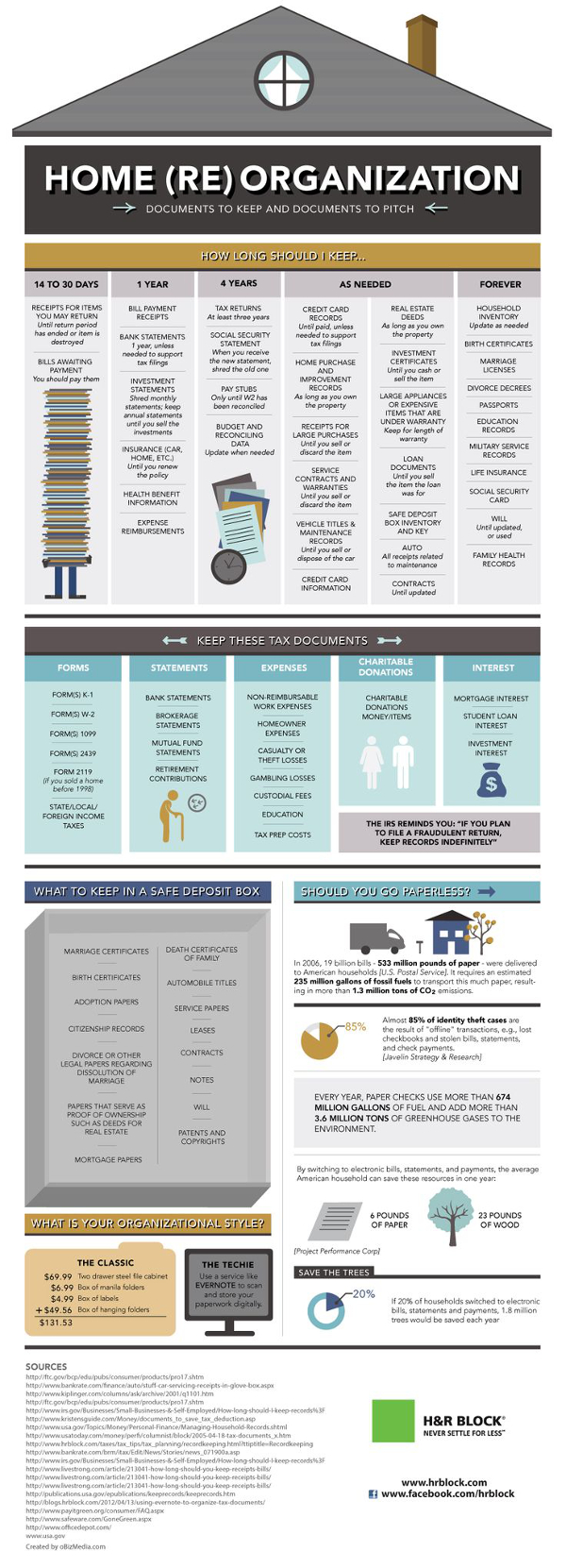

Length of Time to Keep Records

Whether it is one day to one week or one year, ever wonder what papers you should hold on to and for how long? This will soon be laid to rest. By following this outline, you can better coordinate the proper storage solution for your home files. For example, if you have a document that will only need to be saved for a few weeks than be sure not to set aside a permanent folder for it. You may rather choose to use a paper box on your desk for documents requiring an immediate course of action, followed by its disposal.

14 to 30 Days

• Receipts for items you may want to return. Dispose after the return period has ended.

• Bills awaiting immediate payment.

1 Year

• Bill payment receipts.

• Bank statements unless you need for a longer period of time on tax filings.

• Investment statements. Shred monthly but maintain annual statements until their time of sale.

• Keep any insurance documents that are recent. Dispose of when your policy is renewed.

• Health benefit related information.

• Expense reimbursements.

4 Years

• Keep tax records for at least 3 years.

• Social security statements should be kept until a new statement is received. Shred old statements.

• Pay stubs should be kept until your W2 has been reconciled.

• Budget and reconciling data. Update when needed.

Forever

• Household inventory. Updated as needed and applicable for current belongings.

• Birth certificates.

• Marriage licenses.

• Divorce decrees.

• Passports

• Education records.

• Military service records.

• Life insurance.

• Social Security card.

• Family health records.

• Will for as long as it is current and used.

As Needed

• Keep credit card records until paid unless you need them for a tax filing.

• Home purchase and home improvement records for as long as you own the property.

• Receipts for larger purchases until the item is sold or discarded.

• Service contracts and warranties should be kept until they expire or the item is sold.

• Vehicle title and maintenance records for the duration that you own the vehicle.

• Credit card information as needed for current and existing accounts.

• Real estate deeds for as long as you own the property.

• Investment certificates until you cash or sell the item.

• Large appliances or expense items that are under warranty for the duration that it is protected.

• Loan documents until the item is sold.

• Safe deposit box inventory and key.

• Any existing contracts until updated.

Files Related to Taxes

As you are sorting your paperwork, a special pile should be placed aside for all items related to your taxes. A listing of tax documents you should keep are listed below and should be categorized together as outlined below before filing.

Forms

Important forms include K-1, W-2, 1099, and 2119 if your home was sold before 1998. Keep all state, local, and foreign income taxes together.

Statements

Statements that should be categorized with taxes are annual statements from the bank, brokerage statements, mutual fund statements, and retirement contributions.

Expenses

Expenses used for taxes include non-reimbursable work expenses, homeowner expenses, casualty or theft losses, gambling losses, custodial fees, education, and tax prep costs.

Charitable Donations

Any form of charitable donation to include money and items.

Interest

Interest statements that related to mortgage, student loans, and investments should be placed together.

Don’t forget to check out this other post on 8 Ways to Organize Receipts for Tax Time.

What to Store in a Safe Deposit Box

If you ever wondered what a safe deposit box was needed for, here is a list of what you want to keep safely stored.

• Marriage, Birth, and Divorce Certificates.

• Adoption paperwork.

• Citizenship records.

• Papers that service as proof of ownership such as deeds.

• Mortgage papers.

• Death certificates of family members.

• Automobile titles.

• Service papers.

• Leases.

• Contracts, notes, and will.

• Patents and copyrights.

Benefits of Being Paperless

Going digital with your paper can help you to save time and stress. Knowing that your needed documents are stored safely on a digital device can help to remove the visual reminder and burden from your mind. In 2006 alone, over 19 billion bills were delivered accounting for over 533 million pounds of paper. To deliver these to Americans, over 235 million gallons of fossil fuels were used resulting in 1.3 million tons of CO2 emissions.

It is also good to note that 85% of identity theft cases were the result of offline transactions such as lost wallets or checkbooks and stolen bills or statements. The production of checks emits more than 3.6 million tons of greenhouse gasses and use more than 674 million gallons of fuel.

Having bills digitally delivered to you in a single year can save 6 pounds of paper and 23 pounds of wood. If every American household switched to electronic bills and payments, more than 1.8 million trees would be saved each year. Organizing home files the digital way can also save you money on filing cabinets, manila folders, labels, and hanging folders. These costs easily result in more than $130 dollars to get started.