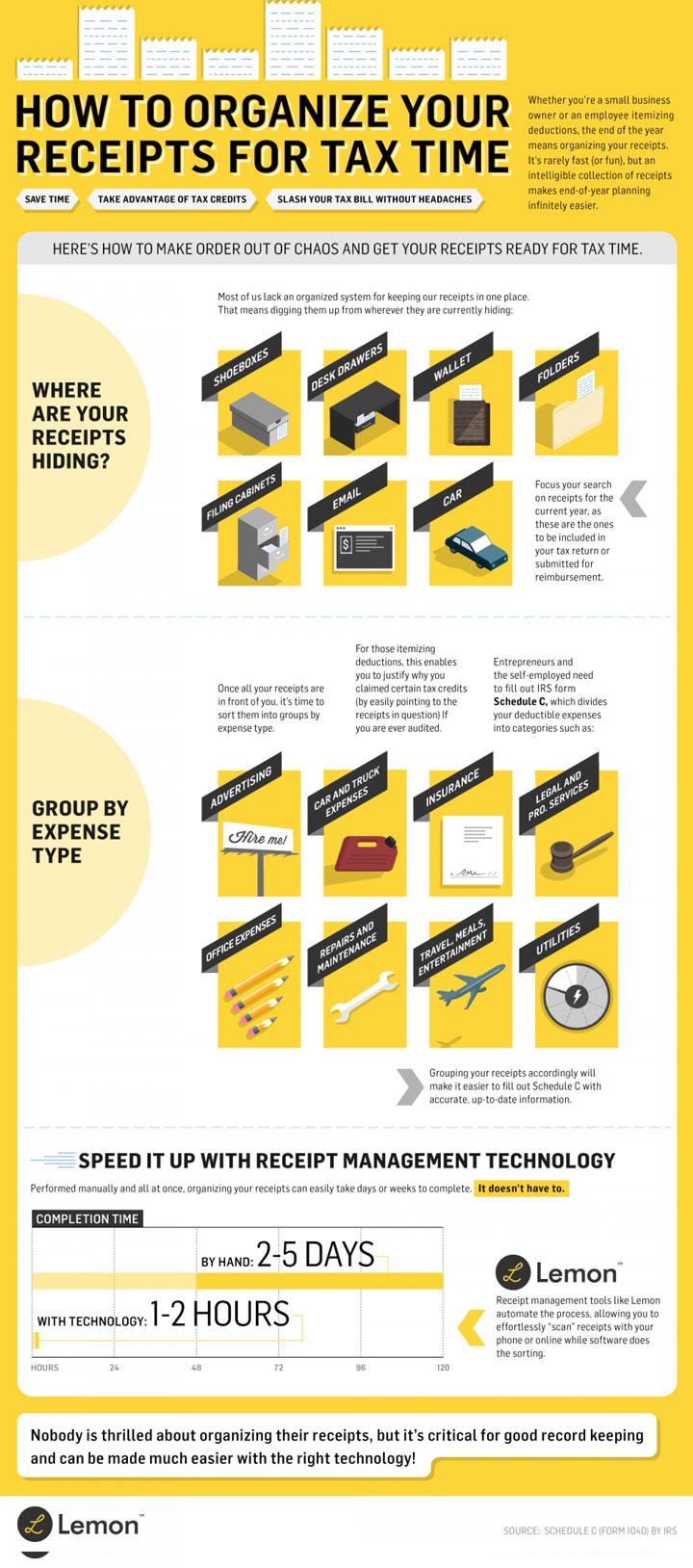

Tax time is here. No matter what your business or employee status is, organizing your receipts is definitely one task that will make this time of year run a lot smoother. Get stress free and save time with these easy ways to organize your receipts for tax time.

Gather Your Receipts Together

The biggest issue individuals suffer from are lost receipts. Very rarely do we ever keep them all in one spot. Receipts are most commonly found hidden in the following places.

• Shoeboxes

• Desk Drawers

• Wallets

• Folders

• Filing Cabinets

• Email

• Car

When you are able to locate your receipts, be sure to focus on the ones dated within the tax year you are submitted for.

Group into Categories

Once you have gathered all your receipts together, it is time to organize them into categories based on expense type. If you are filing for itemized deductions, organizing them by tax credit type will make your filing process quick and keep you organized in case you are every questioned or audited. For self employed individuals expecting to file a Schedule C, receipts can be divided by deduction type. The following list is of the most common categories to group receipts by.

• Advertising

• Car and Truck Expenses

• Insurance

• Legal and Pro Services

• Office Expenses

• Repairs and Maintenance

• Travel, Meals, and Entertainment

• Utilities

After you have groups your receipts together, follow the next series of 8 steps to permanently organize you receipts and convert this otherwise daunting tasks into an easier process for future tax years.

8 Ways to Organize Receipts

1. Keep All Receipts

This cannot be emphasized enough. Your receipts are your evidence to your claim if you are ever audited.

2. Make Notes on Receipts

When you are dining, make a note on the receipt regarding your business purpose so you do not forget. As time passes, you may forget the specific purpose or reason.

3. Scan Receipts and Keep for 6 Years

You can be audited up to 6 years back in some cases if you have severely underpaid your taxes by 25% or more. Because of this it is smart to scan your receipts electronically to maintain for the long term. Keep a backup as well just in case your hard drive crashes.

4. Take a Picture with your Smartphone

Apps have made it easier for your smartphone to track expenses. Use financial software or snap a picture and organize them onto your device.

5. Keep a Business Journal

A daily journal may sound like a tedious task, but using a calendar on Outlook or Google Calendar will help to substantiate various deductions being claimed.

6. Don’t Rely on Credit Card Statements and Cancelled Checks

These are considered insufficient without receipts. An amount does not justify the actual reason for the purchase or details of the expense.

7. Stay Away from Cash

Cash is not your friend. It is difficult to track, easy to spend, and nearly impossible to reconcile with receipts. Use debit or credit cards to better track your expenses and combine those records with your receipts.

8. Organize your Receipts Weekly

Spend 20 minutes a week gathering together any receipts left around to prevent a pile up. Scan them and organized with their related expense or itemized deduction category you established previously.