If you have been successful enough to establish your own personal financial plan, you may quickly realize how much more difficult it is to maintain a budget in the long term in order to reach your long term goals. These easy tips will get you back on track and serve as an easy to follow guideline to your financial future.

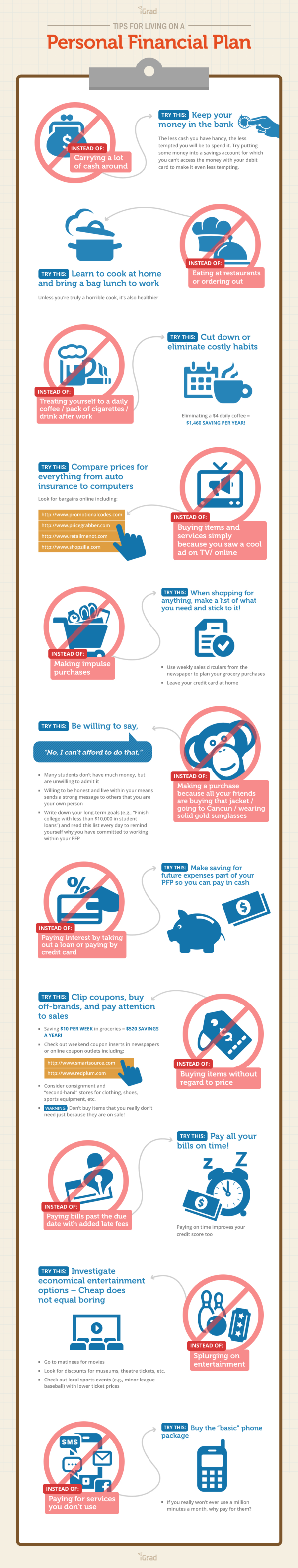

Keep Your Money in the Bank

Carrying cash around can make it to easily accessibly to spend, giving you greater temptation to purchase something rather than save the money. To avoid this issue, make sure a percentage of your paycheck is placed into a savings account each pay period. This will also make it less accessible to be accidentally spent by debit card.

Bag Your Lunch

One of the best ways to cut costs down is to cook at home. This has been proven to not only be healthier for you, but will also save those excess dollars on eating out. With leftovers, bring a bag lunch to work. Many fresh recipes are available online or on mobile apps giving you plenty of varieties to choose from. Your family will also appreciate having the extra time together at home around the dinner table.

Cut Back on Habits

Many people find themselves spending extra dollars on treating themselves to a daily coffee or drink after work. A simple $4.00 a day coffee can cost you more than $1,460 dollars per year. Just think of the money you can save if you cut out other costly habits?

Take the Time to Compare Prices

Do not make rash decisions when purchasing something. Buying items and services should take some time and thought to compare current rates with other competitors in the industry. Look at sites such as the few listed below to perform your own price comparison.

http://promotionalcodes.com

http://pricegrabber.com

http://retailmenot.com

http://shopzilla.com

Avoid Impulse Shopping

The best way to keep your budget on track is to have a shopping list that plans your purchases before you visit the store. Use weekly ads from the newspaper to gauge your grocery purchases and leave credit cards at home. Impulse shopping can crash any budget plan, allowing you to spend money when not planned and exceed your pre-established spending limit.

Only Buy What You Can Afford

Many people find difficulties in purchasing only what they can afford. Just because their friends or media captures the excessive consumption of the newest technology, many individuals are unwilling to admit their inability to afford these things. If you have long term financial goals, write them down in a place where you will see it everyday to help remind yourself.

Save for What You Want

When you want to purchase a high cost item, make savings a part of your future expenses. Paying in cash will help you save on the interest on credit cards and loans in the long run. This will also make shopping financially easier for you during the holidays if you plan for Christmas and other holiday shopping ahead of time.

Use Coupons and Shop for Sales

If you are able to save just $10 on groceries a week, this can total more than $520 a year. Be sure to check out weekend coupon inserts in newspapers or look at online coupon outlets such as:

http://smartsource.com

http://redplum.com

For larger purchases, consider shopping at second hand stores and consignment shops to get quality items at discount. The biggest rule of thumb for sale shopping is to not buy just because it is on sale, but to save money on what it is you need now.

Pay Your Bills On Time

Planning to pay your bills on time will help you to avoid late fees. Not only that but you will also have an improved credit score. Keeping the bills paid when they should also saves you undue stress and heartache, allowing you to focus on more important goals.

Don’t Splurge on Entertainment

If you feel the urge to go to the movies, make it a matinee. Look for discount tickets for theatres, museums, and local sports events. Just because you are on a budget doesn’t mean you can’t have any fun. Just make it affordable within your means.

Only Purchase Services You Use

Why spend more for something, if you don’t use it at all. Purchase basic phone packages if you find yourself not using the data plans for your phone. Why pay for a million minutes, if you never use them. The same goes for memberships and subscriptions you may be paying for.