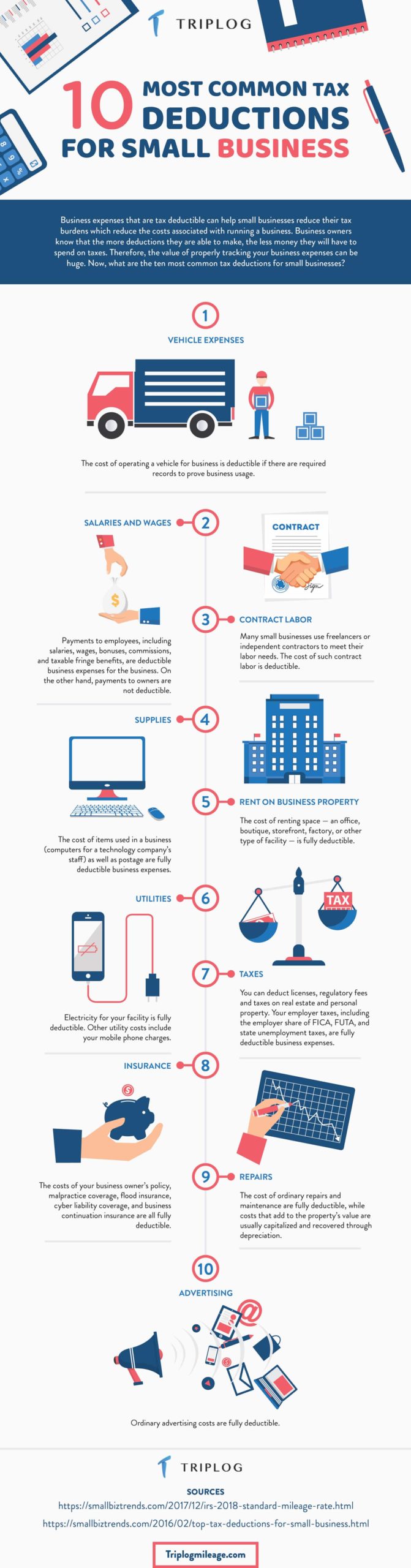

Business expenses can add up for any small business, creating a financial burden. To reduce your tax obligation, keep track of every dollar and cent spent on your business. Here is a look at what the most important tax deductions for your small business are so you can properly plan for your next tax cycle.

1. Vehicle Expenses

If you use your vehicle to conduct your business, you can write off the cost of operating it. To take this business deductible, you may be required to have some records to prove your usage.

2. Salaries and Wages

Another small business tax deduction are payments made to employees for salaries, wages, bonuses, commissions, and more. Payments made to owners are not deductible.

3. Contract Labor

Many small businesses use freelancers or independent contractors to meet their labor needs. The cost of any of these contracts are deductible.

4. Supplies

Small businesses require the use of electronic and digital items to function daily. The cost of all your computers and business supplies as well as postage is fully deductible.

5. Rent

The cost of any leasing storefronts or office space is full deductible. This includes factories, storage, and other types of facilities.

6. Utilities

Electricity for your office space or facility is fully deductible. Other utility costs to consider are mobile phone charges and internet service.

7. Taxes

Any costs for taxes, personal property, and regulatory fees are fully deductible. This also includes the employer share of FICA, FUTA, and state unemployment taxes.

8. Insurance

Many small businesses may have a business owner’s insurance policy to include malpractice coverage, flood insurance, and business continuation insurance.

9. Repairs

The cost of repairs and maintenance related to your property value are usually capitalized and recovered on taxes through depreciation.

10. Advertising

Various advertising costs are fully deductible. From print media, social ads, to online marketing expenses; these tools are both useful for growing your small business and helping you to acquire additional write offs for your taxes.

More Tax Write Offs for Your Small Business

Here is a video you don’t want to miss with more tax write offs for your small business.